Are you tired of sifting through endless credit card options in Pakistan, wondering which one is the right fit for you? Don’t worry—you’re not alone. With banks and financial institutions offering a variety of cards, each boasting unique features, the decision can feel overwhelming. But here’s the good news: we’ve got you covered.

In this detailed guide, we’ll walk you through the best credit cards in Pakistan for 2025, breaking down their perks, potential pitfalls, and everything in between. Whether you’re a jet-setter, a daily spender, or someone looking to build credit, there’s something here for you.

What makes a credit card “the best”? It’s not just about flashy rewards or low interest rates—it’s about finding a card that matches your lifestyle and financial goals. Maybe you want a card with no annual fee to keep costs down, or perhaps you’re after one that showers you with travel points or cashback. Whatever your preference, we’ve researched the top options available in Pakistan to help you decide.

Before we dive into our top picks, let’s cover the essentials you should consider when choosing a credit card. After that, we’ll spotlight the best cards on the market, share tips for using them wisely, and highlight mistakes to avoid. Ready? Let’s get started!

Key Factors to Consider When Choosing a Credit Card

Picking the perfect credit card isn’t a one-size-fits-all process. Here’s what you should keep in mind:

- Interest Rates (APR): If you tend to carry a balance, a low Annual Percentage Rate (APR) is your friend—it keeps interest costs manageable.

- Rewards and Benefits: Love dining out? Look for dining discounts. Frequent flyer? Travel rewards might be your thing. Match the rewards to your spending habits.

- Fees: Watch out for annual fees, foreign transaction fees, or other sneaky charges. Some cards offer amazing perks but come with a catch.

- Credit Limit: Make sure the limit fits your spending needs without tempting you to overspend.

- Customer Service: A reliable support team can save the day when issues pop up—don’t overlook this.

Got those in mind? Great. Now, let’s explore the top credit cards in Pakistan for 2025.

Best Pakistani Credit Card Comparison Tool

Comparison Results

How to Apply for a credit card in Pakistan

To apply for a credit card, you can get in touch with the respective bank’s helplines or apply online through the bank’s website.

Typically, credit cards are offered with certain terms and conditions that apply to both salaried individuals and business owners.

To initiate the credit card application process, you can reach out to the bank’s customer helpline and inquire about the requirements and procedures.

Alternatively, many banks provide online application facilities where you can fill out the necessary information and submit your application electronically.

The eligibility criteria and documentation requirements may vary depending on the bank and the type of credit card you are applying for.

Commonly, banks require applicants to provide proof of income, such as salary slips or bank statements, as well as identification documents such as national ID cards or passports.

• For Bank Alflah Credit Cards.

• For Faysal Bank Credit Cards

• For MCB Bank Credit Cards.

• For Standard Chartered Credit Cards.

• For Habib Bank Credit Cards.

• For UBL Credit Cards.

Normally, 35K and above per month salaried person is being entertained, for the Credit cards.

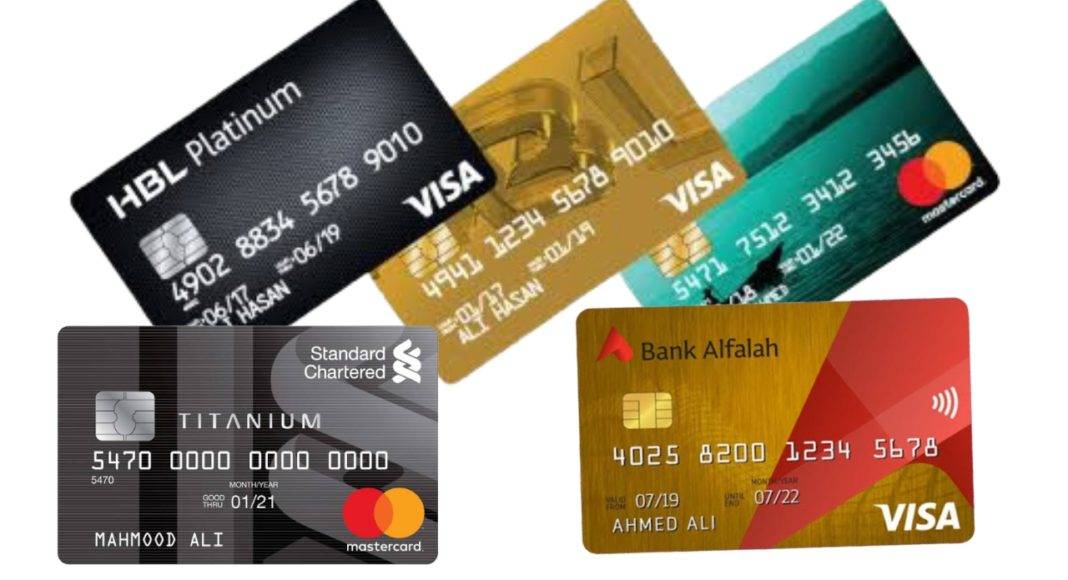

Top Credit Cards in Pakistan

Bank Alflah Credit Card’s

Bank Alflah offers a range of credit cards, including chip-based Visa and MasterCard options for global payment transactions.

The bank provides seven different types of credit cards, with the Ultra Cashback credit card being particularly attractive. This card offers 7.5% cashback on various categories such as shopping, dining, and fueling. By using this credit card, customers can receive up to 18,000 PKR in cashback per year.

Another notable feature of Bank Alflah credit cards is the Orbit Points system, which can be easily redeemed through their mobile application. The bank offers seven different types of credit cards: Platinum, Gold, Classic, Cashback Ultra, American Express, Titanium, and Corporate cards.

One highly useful feature of Bank Alflah credit cards is the availability of a markup-free easy installment plan. Alfa Mall, an associated platform, offers the latest mobile phones, electronic items, and other useful products.

Bank Alflah credit cards provide customers with a variety of options and benefits, including cashback rewards, convenient installment plans, and a range of card types to suit different needs.

Bank Al-Falah MasterCard Optimus Credit Card

The Bank Al-Falah MasterCard Optimus Credit Card is a unique offering specifically designed for young individuals. It allows you to live your life on your own terms and enjoy every moment.

With the Bank Al-Falah MasterCard Optimus credit card, you can experience life to the fullest. Whether you’re dining out, shopping, traveling, or having fun, this credit card provides you with numerous options beyond your imagination.

If you subscribe to the Netflix streaming service using your Bank Al-Falah MasterCard Optimus Credit Card, you can receive a cashback of up to 50% on a one-time subscription.

Bank Al-Falah MasterCard Optimus also offers credit card loans with 0% markup for up to 3 months.

This credit card provides Orbit rewards for local, foreign, and e-commerce transactions. You can earn 1, 2, and 2 orbits respectively on every transaction amounting to 200.

When using this credit card, you can enjoy discounts of up to 40% across the country on shopping, dining, and fueling.

Furthermore, with the Bank Al-Falah credit card, you can access CIP lounges at airports for free internet and snacks.

The Bank Al-Falah MasterCard Optimus Credit Card is designed to cater to the needs and desires of young individuals, allowing them to make the most of their experiences and enjoy various benefits and rewards.

Using this credit card, a 10% discount and cashback can be availed on hotels.com and booking.com.

Main Features of Bank Al-Falah Bank Credit Cards

| Bank | Card Name | Features |

|---|---|---|

| Bank Al-Falah | MasterCard Optimus Credit Card | |

| Target Audience | Young people | |

| Cashback on Netflix Subscription | Up to 50% | |

| Credit Card Loan | 0% Markup for up to 3 months | |

| Orbit Rewards | 1 orbit for every PKR 200 spent locally, 2 orbits for every PKR 200 spent on foreign and e-commerce transactions | |

| Discount Offers | Up to 40% off on shopping, dining, and fueling | |

| CIP Lounge Access | Free access at airports | |

| Discounts and Cashback | 10% discount and cashback on hotels.com and booking.com |

Faysal Bank Credit Card

Faysal Bank offers a wide range of credit cards, providing customers with various options to suit their needs. The bank also provides attractive discount offers to ensure maximum satisfaction for the users.

One of the benefits of Faysal Bank credit cards is the points earned on shopping. Customers earn one point for every 25 rupees spent, and each point is worth 0.20 PKR. These points can be used at different outlets across the country.

Faysal Bank offers several facilities such as dial-a-draft, balance transfer, advance cash, and utility bill payments to make banking convenient for its customers.

The annual service charges for Faysal Bank credit cards differ based on the card type. The charges are 3500 PKR for Standard, 6000 PKR for Gold, and 7000 PKR for Titanium cards. These charges are applicable once a year and can be offset by meeting certain spending requirements.

Faysal Bank also provides a 0% markup installment plan for purchasing electronic essentials, offering different payment options.

It’s important to note that Faysal Bank credit card services are available primarily in major cities such as Karachi, Lahore, Multan, Rawalpindi, Islamabad, Peshawar, and other large cities.

Customers can withdraw up to 45% of their assigned credit limit as cash from ATMs. However, it’s important to keep in mind that every transaction incurs a daily mark-up rate.

Main Features of Faysal Bank Credit Cards

| Features | Details |

|---|---|

| Rewards Program | Earn 1 point for every 25 rupees spent while shopping. Each point is worth 0.20 PKR and can be redeemed at various outlets across the country. |

| Facilities | Dial a draft, balance transfer, advance cash, and utility bill payments. |

| Annual Service Charges | Standard: 3500 PKR <br> Gold: 6000 PKR <br> Titanium: 7000 PKR |

| Fee Redemption | Service fee is charged once a year, but can be earned back by spending a certain amount on purchases. |

| Installment Plan | 0% mark-up installment plan available for electronic essentials with various payment options. |

| Availability | Offers are available only in major cities such as Karachi, Lahore, Multan, Rawalpindi, Islamabad, Peshawar, and some other large cities. |

| Cash Withdrawal | Customers can withdraw up to 45% of their assigned cash limit from ATMs. Each transaction is subject to a daily mark-up rate. |

Muslim Commercial Bank (MCB) Credit Cards

MCB Bank provides three categories of credit cards: Classic, Gold, and Titanium. One of the main features of MCB credit cards is their availability. They can be obtained from any branch of MCB Bank in Pakistan.

With MCB credit cards, customers can enjoy a cash limit of 75% of the assigned credit limit. Additionally, these cards can be used to pay utility bills across all sectors.

MCB offers convenient installment plans for educational fee payments, allowing customers to pay in three monthly installments. Furthermore, MCB Visa Credit Card holders are rewarded with points for every transaction, earning 1 point for every PKR 50 spent.

Users have the flexibility to redeem their accumulated reward points for any product of their choice from the I Shop catalog. MCB also provides various insurance plans, including coverage for fraud, theft, life, education, and more.

MCB credit cardholders can benefit from the Priority Pass program, which is the world’s largest independent airport VIP lounge program. With MCB cards, customers can access over 600 lounges worldwide.

Currently, Daraz.pk offers a special 0% markup installment plan for 12 months exclusively for MCB credit cardholders.

Main Features of MCB Bank Credit Cards

| Features | Details |

|---|---|

| Cash Limit | MCB offers 75% cash limit from the assigned limit. |

| Utility Bill Payments | MCB credit card holders can pay utility bills across all utility sectors. |

| Educational Fee Payments | MCB offers a three-month installment plan for educational fee payments. |

| Rewards Program | MCB Visa Credit Card holders earn 1 point for every PKR 50 spent. |

| Reward Point Redemption | Reward points can be redeemed for any product of the user’s choice from the I Shop catalogue. |

| Insurance Plan | MCB offers insurance plans for items including fraud, theft, life, and education. |

| Priority Pass Program | MCB cardholders can access over 600 VIP lounges worldwide through the Priority Pass program. |

| Daraz.pk Offer | Currently, MCB credit card holders can avail a 0% mark-up installment plan for 12 months on Daraz.pk purchases. |

Standard Chartered Credit Cards

SCB offers four categories of credit cards Silver, Gold, Platinum, and Titanium, Standard Chartered Credit Cards can be used at more than 50,000 establishments in Pakistan and millions of locations across the world.

For every Rs. 50 rupees you spend on your Credit Card, the bank offers 1 Reward point, and these reward points can be redeemed from a range of exciting gifts present in their Rewards Catalogue.

Bank offers a 30% Cash limit from the assigned limit on Visa Gold and Classic and other cards.

The one another useful feature of the SCB Credit card is you can transfer your other Credit Card’s outstanding balance to your Standard Chartered Credit Card.With a nominal financial charge of 3.25% per month on Visa and MasterCard both.

Titanium Credit Card offers 5% cash back on the Fuelling and supermarket users can avail the 10,000 PKR per annum. The card also offers 3% cash back on Electronic outlets.

Standard Chartered Cashback Credit Card – Best for Savvy Shoppers

If you’re all about getting a little back on every purchase, the Standard Chartered Cashback Credit Card is your go-to. It’s perfect for everyday spending.

- Key Features:

- 5% cashback on groceries and fuel—essentials covered!

- 2% cashback on dining and entertainment.

- No annual fee for the first year.

- Benefits:

- Simple, redeemable cashback that feels like a discount every time you swipe.

- Extra discounts at partner retailers sweeten the deal.

- Drawbacks:

- Cashback rates dip after year one, so keep an eye on its long-term value.

Users Experience: My friends has been using this card for groceries, and the 5% cashback has shaved a noticeable chunk off my monthly bills. It’s like a reward for buying milk and bread!

SCB cards offer Complimentary access to CIP lounges in Karachi, Lahore, and Islamabad airports.

Standard Chartered Bank credit cards are offered only in the selected cities of Pakistan it is mandatory every applicant should have the same address for work and residence.

Main Features of Standard Charted Bank Credit Cards

| Features | Details |

|---|---|

| Credit Card Categories | SCB offers four categories of credit cards: Silver, Gold, Platinum, and Titanium. |

| Acceptance | Standard Chartered Credit Cards can be used at over 50,000 establishments in Pakistan and millions of locations worldwide. |

| Rewards Program | Customers earn 1 Reward point for every Rs. 50 spent on their credit card, and these points can be redeemed for exciting gifts in the Rewards Catalogue. |

| Cash Limit | SCB offers a 30% cash limit from the assigned limit on Visa Gold, Classic, and other cards. |

| Balance Transfer | Cardholders can transfer the outstanding balance of other credit cards to their Standard Chartered Credit Card at a financial charge of 3.25% per month on Visa and MasterCard. |

| Cash Back | Titanium Credit Card holders can avail 5% cash back on fueling and supermarket purchases up to PKR 10,000 per annum, and 3% cash back on electronic outlets. |

| Lounge Access | SCB Credit Card holders can access CIP lounges in Karachi, Lahore, and Islamabad airports for free. |

| Availability | Standard Chartered Bank credit cards are offered only in selected cities of Pakistan, and the applicant must have the same address for work and residence. |

Habib Bank Credit Cards

HBL offers Platinum, Gold, Green, and Fuel saver credit cards in Pakistan HBL CreditCard is accepted at millions of outlets worldwide, making shopping even more exciting by providing discount offers.

HBL Fuel Saver Green and Gold credit cards offer 3% and 5% Cashback from the total spending of the cards, the annual fee for the Gold and Green cards is 6000 and 3000 per annum respectively.

HBL bank offers one redeemable point on the spending of 25 rupees, all these earned points can be redeemed through their rewards Catalogue, with Platinum cards

HBL provides the 3 times more points, this reward program is not applicable to Fuelling Saver cards. The Annual fee can get back on the spending of 25,000 rupees in three months.

HBL Platinum Credit Card – Best for Frequent Travelers

For those who live with a suitcase half-packed, the HBL Platinum Credit Card is a dream come true. It’s loaded with travel-friendly features that make every trip more rewarding.

- Key Features:

- No foreign transaction fees—a rarity that saves you big on international spending.

- Access to airport lounges worldwide, turning layovers into a luxury.

- Earn 2 reward points for every PKR 100 spent on travel purchases.

- Benefits:

- The travel rewards pile up fast, cutting costs on flights and hotels.

- Free travel insurance adds peace of mind for your adventures.

- Drawbacks:

- The annual fee is steep—only worth it if you travel often enough to offset it.

My Experience: I took this card on a trip to Dubai last year. Skipping foreign transaction fees saved me hundreds of rupees, and the lounge access? A total game-changer during a six-hour layover.

Main Features of HBL Bank Credit Cards

| Features | Details |

|---|---|

| Credit Card Categories | HBL offers Platinum, Gold, Green, and Fuel Saver credit cards in Pakistan. |

| Acceptance | HBL Credit Cards are accepted at millions of outlets worldwide, providing exciting discounts and offers. |

| Cashback | HBL Fuel Saver Green and Gold credit cards offer 3% and 5% cashback on the total spending of the cards. |

| Annual Fee | The annual fee for Gold and Green cards is PKR 6,000 and PKR 3,000, respectively. |

| Rewards Program | HBL offers one redeemable point on spending of PKR 25, and these points can be redeemed through their Rewards Catalogue. Platinum cardholders can earn three times more points, but this program is not applicable to Fuel Saver cards. |

| Fee Waiver | The annual fee can be waived on spending of PKR 25,000 within three months. |

United Bank Credit Cards

UBL offers three types of credit cards in Pakistan – Platinum, PSO, and Chip-based cards.

- UBL PSO Credit Card:

- UBL PSO credit cards offer unique features and extraordinary benefits that make them the most rewarding card in the city.

- Users get a refund every time they buy fuel with their UBL PSO credit card.

- Users can avail 5% cashback when PSO UBL Auto Credit is only returned to PSO service stations (subject to a maximum of Rs. 1250 per customer per month).

- Users can avail 1% cashback when the PSO UBL car credit card is used in all stores (subject to a maximum amount of Rs 1,000 per customer per month).

- UBL Platinum Credit Card:

- Users are awarded air miles for every Rs 50/- spent locally and are awarded one reward point. They can earn 3x rewards on foreign spending.

- UBL Chip-based Credit Card:

- The UBL Chip-based credit card is designed with state-of-the-art technology, making it a highly secure card.

- The card comes with a built-in chip that provides added security against fraud.

All UBL credit cards offer free access to CIP Lounges with one guest at Karachi, Lahore, Islamabad, and Multan airports on international travel. Cardholders can also access over 1,000 VIP airport lounges internationally using the Priority Pass application.

JS Bank Credit Cards

JS Credit Cards are designed specifically for your unique lifestyle. Whether you’re a frequent traveler, a fashion enthusiast, or a foodie, our cards offer a plethora of benefits to enhance your experiences. Get ready to enjoy exclusive access to domestic and CIP lounges, along with incredible discounts and offers on travel, apparel, restaurants, and much more!

Bank offers a range of card variants tailored to meet your diverse needs:

- JS Classic Credit Card

- JS Gold Credit Card

- JS Platinum Credit Card

- JS Signature Credit Card

Let’s explore the key features that make JS Credit Cards truly exceptional:

Attractive Discounts: Unlock amazing discounts from a wide array of vendors across Pakistan, making every purchase a delightful experience.

Supplementary Cards: Extend the benefits to your loved ones with up to 6 supplementary Credit Cards. You have the flexibility to specify the credit limit for each card, ensuring everyone enjoys the perks that suit them best.

JS Bank Credit Protector: Your peace of mind matters to us. In the unfortunate event of an incident, our Credit Protector takes care of the outstanding amount due on your JS Bank Credit Card, providing you with financial security*.

Balance Transfer Facility: Say goodbye to multiple bills and consolidate your debts effortlessly. Transfer your current Credit Card balances or personal loans to your JS Bank Credit Card, simplifying your finances. Just call at 021 111 654 321 to get started.

Convenient Repayment Process: We offer you flexibility in repaying your dues. Opt for our Auto-Debit payment service for hassle-free payments or choose to fill out a deposit slip and deposit your cheque or cash at any JS branch’s teller counter or drop it securely in our convenient drop boxes.

Now, let’s delve into the specifics of each JS Credit Card variant:

- Classic:

- Credit Card Limit: PKR 99,999

- Annual Fee: PKR 2,750

- Gold:

- Credit Card Limit: PKR 349,999

- Annual Fee: PKR 4,500

- Platinum:

- Credit Card Limit: PKR 2 Million

- Annual Fee: PKR 8,000

And the best part is, Bank offers no annual fee for up to 6 supplementary Credit Cards!

Are you concerned about the annual fee? Don’t worry! You have the opportunity to reverse the annual fee by simply spending within 60 days.

With JS Credit Cards, you gain access to exclusive lounges. While the Classic variant provides access to JS Domestic Lounge, the Gold and Platinum variants offer access to both JS Domestic Lounge and CIP Lounge International.

We understand the importance of transparent terms and conditions. Here are a few essential details to consider:

- APR for Cash Advance/Retail Transaction: 45%

- BTF (Balance Transfer Facility) APR: Up to 28%

- Credit Protector: Get insurance coverage against natural death and disability at just 0.48% of the outstanding amount.

- Minimum Monthly Salary Required: PKR 35,000

Embark on a rewarding journey with JS Credit Cards today and enjoy a world of convenience, flexibility, and exceptional service.

How to Choose the Right Credit Card for You

Finding “the one” depends on you—your habits, goals, and budget. Here’s how to narrow it down:

- Know Your Spending: Where does your money go? Travel rewards shine for globetrotters, while cashback suits daily shoppers.

- Check Your Credit: Some cards need a solid credit score. Starting out? Pick one that’s easier to get.

- Weigh the Fees: High fees can cancel out rewards. Do the math to see if it’s worth it.

- Read the Details: Dig into the fine print—interest rates, reward rules, and fees can make or break a card.

Tips for Using Credit Cards Wisely

Credit cards are powerful tools, but they’re not free money. Here’s how to stay in control:

- Pay in Full: Clear your balance monthly to dodge interest charges.

- Stick to a Budget: Only spend what you can repay—think of it like a debit card with perks.

- Track Your Spending: Check statements regularly for errors or fraud.

- Skip Impulse Buys: A high limit isn’t an invitation to splurge. Stay disciplined.

Mistakes to Avoid

Even seasoned cardholders slip up. Watch out for these:

- Missing Payments: Late payments ding your credit and add fees. Set reminders or autopay.

- Overlooking Fees: Annual or foreign transaction fees can sneak up on you—know what you’re signing up for.

- Too Many Applications: Each application nudges your credit score down a bit. Apply thoughtfully.

Choosing the best credit card in Pakistan doesn’t have to be a headache. Whether it’s the HBL Platinum for travel, Standard Chartered for cashback, or MCB Lite for building credit, there’s a card tailored to your needs. The trick? Match it to your lifestyle, use it smartly, and enjoy the benefits without the stress.

So, take a moment to think about what you want from a credit card. Then, armed with this guide, pick one that’ll make your wallet—and your life—a little happier in 2025.

It’s important to consider all of these factors when choosing a credit card, as they can have a significant impact on the value of the card and how well it suits your needs, Please share your experience in the comment box.