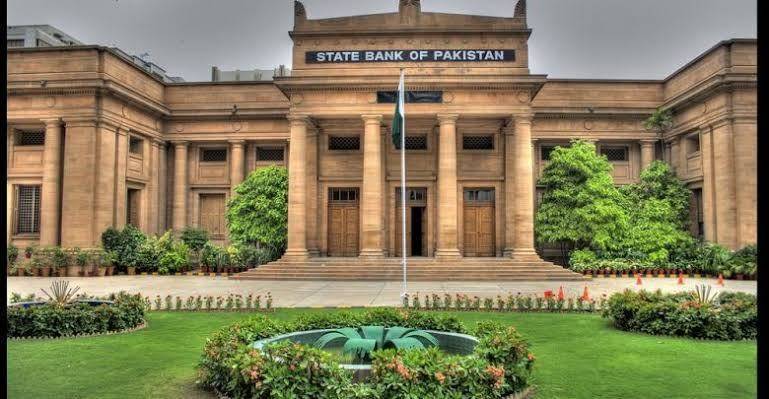

State Bank of Pakistan (SBP) has cut premium rates for two of its refinancing programs from 7 to 6 percentage points to 5 percentage points, according to a statement released Wednesday.

In particular, SBP has lowered the premium rates for end users for the Temporary Economic Refinancing Facility (TERF) from the current 7 to 5 percent and for the Long-term Financing Facility (LTFF) for the non-textile sector from 6 to 5 percent.

2/2 SBP has also allowed TERF facility in cases where LCs/Inland LCs were opened prior, but retiring after the introduction of scheme on 17Mar20. TERF was introduced to provide a time bound incentive for investment in all sectors. https://t.co/Ix46d0uO6C

— SBP (@StateBank_Pak) July 8, 2020

In its statement, the SBP said the central bank has cut base rates by 625 basis points to 7 percentage points since March 17.

“To extend the benefits of this rate cut to users of its refinancing systems, SBP has now decided to align the markings for end users with two of its refinancing systems to encourage investment in the country,” said SBP.

TERF was launched on March 17 to strengthen the economy by supporting, balancing, modernizing and restructuring new projects. Under this program, Rs 10.5 billion was approved by banks for 21 projects by July 2.

Under the new interest rates, SBP is now refinancing banks to 1 percent, with a maximum margin of 4 percent.

Read Also: SBP has made visible reduction in interest rates

LTFF was previously available for export-oriented projects to purchase imported and locally produced new machines and equipment. However, in March SBP opened LTFF everywhere for all sectors.

Previously, the additional rate for end-users in this scheme was 5 percentage points for the textile sector and 6 percentage points for the non-textile sectors. The State Bank has now cut its refinancing rate for the non-textile sector by 1 percentage point, and therefore the interest for the end-user for all sectors will be 5 percentage point everywhere.

The State Bank of Pakistan (SBP) has noted the negative impact of the COVID-19 pandemic on the economy and has taken measures to protect businesses and households since March 2020. Reducing governance has been an important step since March 2020 .