Worldwide, interest rates have been cut by central banks in several countries due to the economic downturn due to the effects of COVID-19. Pakistan is one of the countries that has significantly lowered the base rate in terms of basis points, even though it remains at a higher level compared to other countries.

The Monetary Policy Committee (MPC) has cut the policy rate by 100 basis points to 8 percent in a period two months.

This decision reflects the MPC’s view that inflation expectations have further improved, given the recent decline in domestic fuel prices. As a result, inflation could fall closer to the lower end of the previously announced margins from 11 to 12 percent this fiscal year and next fiscal year from 7 to 9 percent.

The overall interest rate was cut by 5.45 percent from 13.25 percent, meaning a significant drop in such a short time.

The MPC emphasized that the coronavirus pandemic has created unique monetary policy challenges because of its non-economic origins and the temporary interruption of economic activities needed to combat it.

While a simplified monetary policy cannot affect the contagion rate or prevent a short-term decline in economic activity due to closings, it can provide households and companies with liquidity support to support them in the subsequent temporary phase of economic disruption.

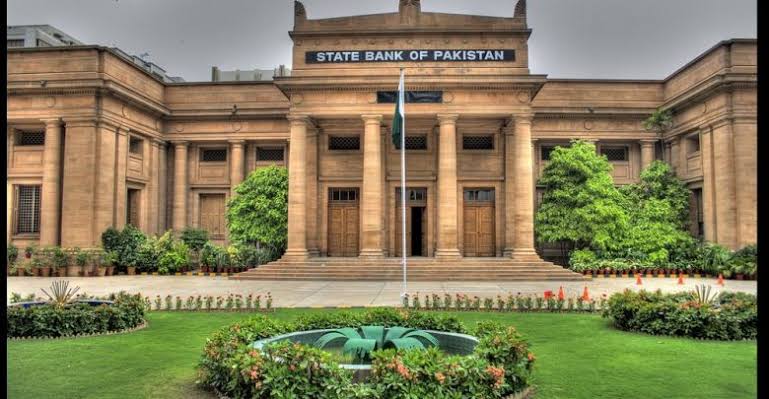

In particular, the gradual interest rates and significant low-cost loans from SBP’s extensive refinancing facilities have helped maintain credit flows, strengthen borrowers’ cash flows and support asset prices.

This included tightening economic conditions that would otherwise have exacerbated the initially necessary decline in activity.

In its decision, MPC took into account the main trends and perspectives in the real, external and fiscal sectors, as well as the resulting prospects for monetary conditions and inflation.

MPC has identified three major developments since the last MPC meeting on April 16, 2020. First, the government cut gas and diesel prices by 30 to 40 percent in response to the continued drop in global oil prices, which has prospects for inflation improved. Second, most countries, including Pakistan, have started facilitating closures, which should support economic activity.

Recent supportive developments have helped SBP’s position in foreign reserves return to pre-coronavirus levels above $ 12 billion.

Realstate sector

The financial data coincides with the expected sudden and sharp decline in activity. LSM saw a sharp 23 percent decline in March from a year earlier when economic and social activity retreated to curb the virus.

High-frequency demand indicators such as credit card spending, cement transfers, loan purchases and POL sales also point to a marked decline in domestic activity in both March and April.

At the same time, mood among consumers and businesses has fallen sharply as signs of improvement early this year.

Recently, the government has begun to gradually lift restrictions on various economic sectors that depend on the future course of the pandemic. If this lighting goes smoothly, activity should resume in the coming months.

MPC noted that based on preliminary evidence from China and other countries that the blockade eased earlier than others, the service and consumption activities that make up much of the domestic economy could remain subdued.

External sector

The current account deficit has narrowed, although both exports and imports have fallen sharply since the outbreak of the corona virus. Exports declined by 10.8 percent in March from a year earlier. After some recovery in recent months, imports decreased by 19.3 percent (compared to the previous year).

The April figures from Pakistan’s Statistical Office show an even greater decline in both exports (54 percent) and imports (32 percent). While shipments have remained stable, there are potential downside risks to global economic difficulties, especially in oil-exporting countries.

Despite challenging global conditions, the outlook for the foreign sector remains generally stable.