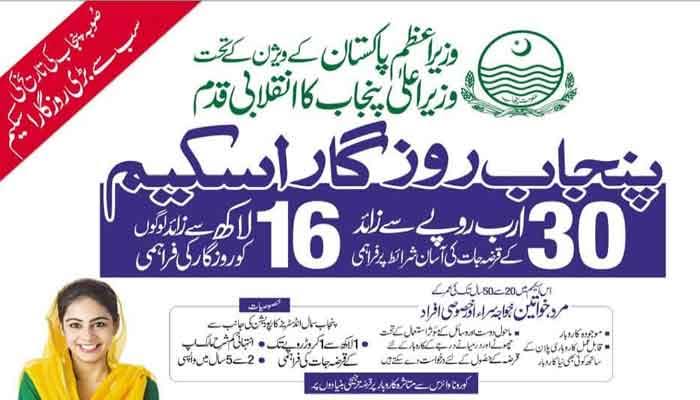

The Punjab Rozgar Scheme 2023 is an initiative launched by the Government of Punjab, Pakistan, to provide loans to small, medium, and home-based industries through commercial banks.

The scheme aims to boost employment opportunities in the state by providing financial assistance to existing businesses and start-ups of new businesses. The program is also focused on reducing the cost of trade taxes for eligible businesses.

The Punjab Rozgar Scheme is a part of the Government of Pakistan’s efforts to provide relief to businesses impacted by the COVID-19 pandemic.

Eligibility Criteria for Punjab Rozgar Scheme 2023

To be eligible for processing loan applications under the Punjab Employment Scheme, applicants must fulfill certain criteria. The eligibility requirements are as follows:

- Age: Applicants must be between 20 to 50 years old.

- Gender: The scheme offers loans to both male and female applicants, as well as transgender individuals.

- Residency: Applicants must be citizens of Pakistan and residents of Punjab, verified through their CNIC.

- Business Location: The business must be located in Punjab.

- Business Type: The business can be a sole proprietorship, partnership, or any other type of business that meets the other eligibility criteria.

- Credit History: The applicant must have a clean e-CIB/credit history.

- For Startups/New Businesses: The applicant must have a viable business plan.

- For Existing Businesses with a focus on sustaining COVID-19: The applicant must have a viable business plan with a focus on sustaining the impact of COVID-19.

- The Punjab Rozgar Scheme’s online registration process is available on the official website of the Government of Punjab. To register for the program, interested applicants can follow the steps given below:

- Punjab Rozgar Scheme Online Registration and Application.

- Visit the official website of the Government of Punjab.

- Click on the “sign-up” button and fill out the form with accurate details.

- Upload the required documents such as a photo, front and backside of CNIC, and experience certificate.

- Submit the application and wait for confirmation.

Punjab Rozgar Scheme Loan Calculator

The Punjab Rozgar Scheme offers loans ranging from 100,000 to 10,000,000 for two to five years at a low-interest rate. Applicants can use the Punjab Rozgar Scheme loan calculator to estimate the amount of loan they are eligible for.

How to Check the Status of Punjab Rozgar Scheme Application

Applicants who have registered for the Punjab Rozgar Scheme can check their eligibility status by following the steps given below:

- Visit the official website of the Government of Punjab.

- Click on the Punjab Rozgar scheme login button.

- Enter your Gmail and password.

- Check your eligibility status.

Required Documents for Punjab Rozgar Scheme Application

Applicants must provide the following documents while applying for the Punjab Rozgar Scheme:

- A good photo of themselves for registration

- The front and backside of the CNIC card

- Experience certificate

- Previous month’s bank statement, etc.

Important Information

Applicants must ensure that the documents they submit to the Government of Punjab are accurate.

Any incorrect information can result in legal action. No changes or modifications are allowed after the submission of the application.

Applicants should provide as much information about themselves as requested.

After submitting the form, applicants will receive an application registration number (ARN) and an SMS confirming their application submission.