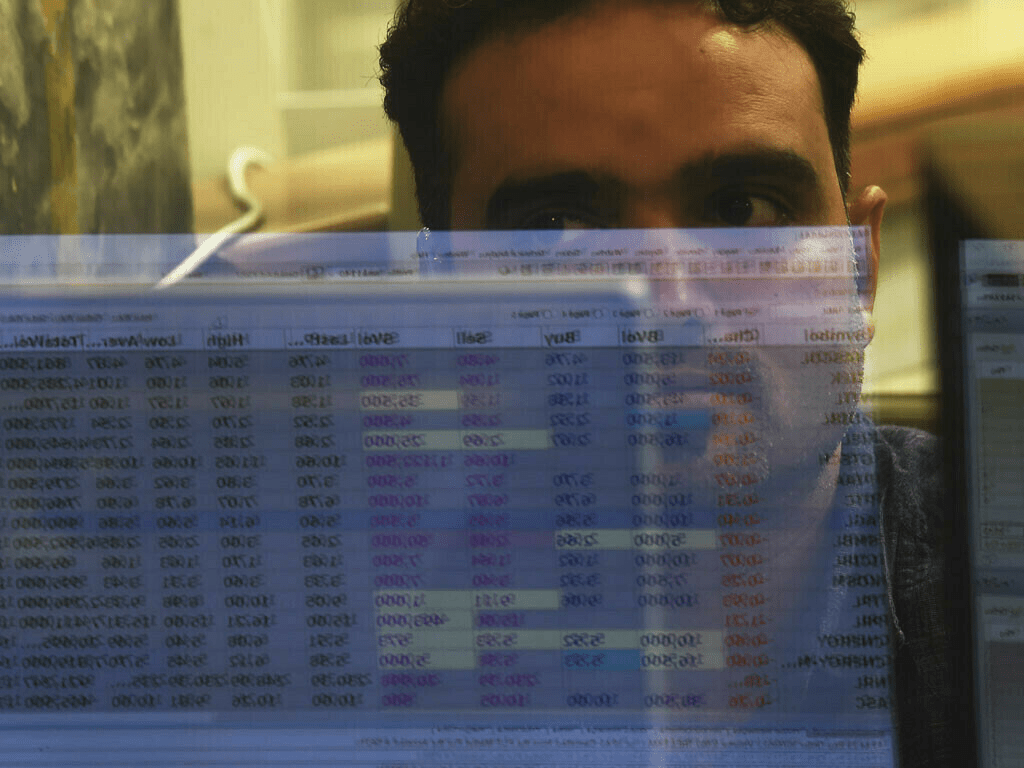

The Pakistan Stock Exchange (PSX) marked a notable positive shift on Friday as the benchmark KSE-100 Index rallied to gain an impressive 1,435.34 points, closing at 115,272.08.

This significant recovery signals renewed investor confidence amidst ongoing political and economic developments in the country.

Early Trading Hours Witness Selling Pressure

The trading day commenced with selling pressure, leading the KSE-100 Index to dip to an intra-day low of 113,571.96. However, the bearish sentiment proved short-lived as bullish activity gradually took over.

Following the initial downturn, strong buying momentum propelled the index to an intraday high of 115,356.12. At the close, the benchmark index had settled at 115,272.08, reflecting a 1.26% increase.

Key Sectors Witness Growth

- Automobile Assemblers

- Cement

- Fertilizer

- Oil and Gas Exploration Companies

- OMCs (Oil Marketing Companies)

- Power Generation

- Refinery

Top Performing Stocks

- NRL (National Refinery Limited)

- PRL (Pakistan Refinery Limited)

- HUBCO (Hub Power Company)

- PSO (Pakistan State Oil)

- SNGP (Sui Northern Gas Pipelines)

- SSGC (Sui Southern Gas Company)

- MARI (Mari Petroleum Company Limited)

- OGDC (Oil and Gas Development Company)

- ENGRO Corporation

- HBL (Habib Bank Limited)

- UBL (United Bank Limited)

Economic Indicators Supporting Market Sentiment

According to the State Bank of Pakistan (SBP), the current account surplus reached $582 million in December 2024, marking a remarkable 109% increase compared to the same period the previous year. This development underscores improved macroeconomic stability.

Net Foreign Direct Investment (FDI) rose by 20% in the first half of FY25, totaling $1.329 billion, further bolstering investor confidence.

Pakistan’s REER climbed to 103.7 in December 2024, up from 103.02 in November 2024. This indicates a stronger currency and enhanced competitiveness in global markets.

Imran Khan’s Conviction and Its Market Impact

The political landscape took a dramatic turn with the conviction of Imran Khan, the founding chairman of PTI, in the £190 million Al-Qadir Trust case. This development raised concerns over political stability, yet the market remained resilient, showcasing underlying strength.

Market analysts from Intermarket Securities noted a slowdown in mutual fund conversions, reflecting cautious investor sentiment. Despite this, the overall trajectory remained optimistic.

Global Market Trends and Their Influence

- Japanese Equities: The Nikkei index experienced its worst week in three months amidst speculation of a Bank of Japan rate hike.

- Chinese Stocks: China’s economy grew by 5.4% in Q4 2024, exceeding expectations. Mainland Chinese blue chips rose by 0.3%, while the Hang Seng index edged up by 0.14%.

- Global Benchmarks: MSCI’s world index slightly declined by 0.05%, and its Asia-Pacific index fell by 0.4%.

- The Pakistani Rupee appreciated by 0.05% against the US dollar, closing at 278.71.

- The Chinese Yuan strengthened marginally to 7.34 per dollar in offshore trading.

- All-Share Index Volume: Increased to 549.58 million from 469.44 million on Thursday.

- Share Value: Declined to Rs35.93 billion, compared to Rs24.98 billion in the previous session.

- WorldCall Telecom: Topped the list with 101.93 million shares traded.

- Hub Power Co.: Recorded a volume of 36.89 million shares.

- Hascol Petroleum: Traded 32.50 million shares.

Market Breadth

Out of the 461 companies traded:

- 264 registered gains.

- 128 recorded losses.

- 69 remained unchanged.