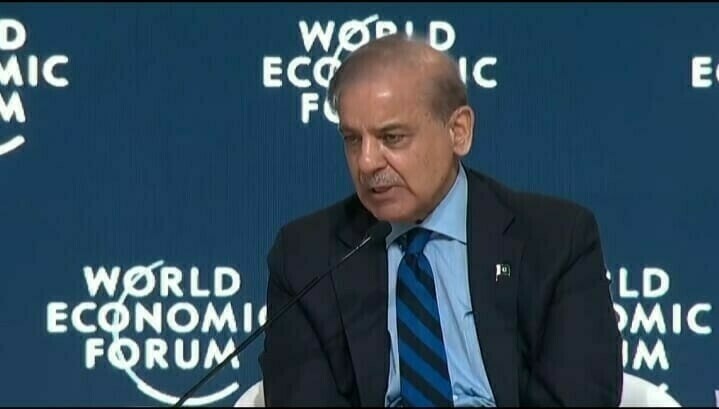

The Prime Minister of Pakistan, Shehbaz Sharif, recently commended the State Bank of Pakistan (SBP) for its decision to reduce the policy rate by 1%. In this article, we explore the implications of this decision, its impact on the economy, and how it reflects the government’s broader commitment to economic stability.

The reduction in the policy rate comes as a response to the country’s declining inflation trends. Lower inflation not only enhances the purchasing power of citizens but also creates a stable economic environment for businesses to thrive.

The prime minister expressed optimism that inflation rates would continue to decline in the coming months, further solidifying the foundation for sustained economic growth.

As inflation rates drop, consumer confidence rises, leading to increased spending. Additionally, lower inflation provides businesses with predictability in planning and investment, which is essential for long-term economic stability.

Acknowledging Efforts

Prime Minister Shehbaz Sharif took the opportunity to acknowledge the dedicated efforts of Finance Minister Muhammad Aurangzeb and the relevant departments in steering the country toward economic recovery. The prime minister praised their commitment to implementing policies that prioritize fiscal responsibility and economic revitalization.

These measures are part of a broader strategy to restore confidence in Pakistan’s economy. By addressing critical challenges such as inflation, high borrowing costs, and stagnant investment, the government aims to create a sustainable growth trajectory for the nation.

One of the primary objectives of reducing the policy rate is to enhance investor confidence. High borrowing costs have traditionally been a deterrent for businesses seeking to expand or initiate new ventures.

With the policy rate now at 12%, investors are likely to find it more feasible to access financing, which could lead to increased investment in various industries.

This policy shift is particularly significant for sectors such as manufacturing, agriculture, and services, which are key drivers of Pakistan’s economy. By making credit more affordable, the government is enabling these sectors to scale operations, create jobs, and contribute to GDP growth.

Encouraging Foreign

Lower borrowing costs and a stable economic outlook make Pakistan an attractive destination for international investors.

The government’s efforts to create a business-friendly environment, coupled with this monetary policy adjustment, send a clear message to global markets that Pakistan is open for business.

Increased FDI not only brings much-needed capital into the country but also facilitates the transfer of technology, expertise, and global best practices. These factors are crucial for enhancing productivity and competitiveness in Pakistan’s key economic sectors.