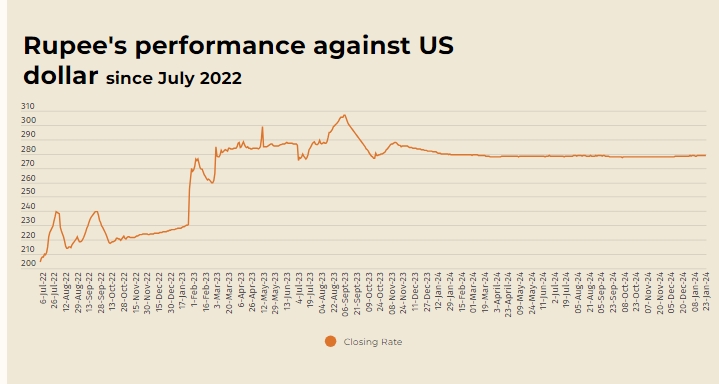

The value of the Pakistani rupee (PKR) continues to be a focal point for market analysts and businesses as it recorded a marginal improvement against the US dollar.

On Thursday, the rupee appreciated by 0.05% in the interbank market, closing at 278.72, up by Re0.13 from the previous day.

This comes amidst global market uncertainty and key announcements expected from major central banks.

In this blog, we delve into the factors influencing the rupee’s recent performance, the global economic backdrop, and what this means for Pakistan’s economy.

Factors Driving the Pakistani Rupee’s Recent Performance

1. Domestic Exchange Rate Stability

The State Bank of Pakistan (SBP) reported that the rupee improved slightly compared to Wednesday’s closing of 278.85. While the gain appears modest, it reflects efforts to stabilize the currency amidst rising inflation and external debt challenges.

2. Global Dollar Trends

The US dollar index held steady at 108.25 on Thursday after slight gains earlier in the week. Market analysts attribute this stability to expectations of major central bank policy decisions, including the US Federal Reserve, the European Central Bank (ECB), and the Bank of Japan.

3. Impact of Oil Prices

Brent crude futures dipped slightly to $78.98 per barrel, while WTI crude remained stable at $75.40. With Pakistan being a net oil importer, fluctuations in oil prices directly influence the rupee’s parity against major currencies.

Upcoming Interest Rate Decisions

The US Federal Reserve is set to announce its rate decision next week, with the ECB and Bank of Japan following suit.

Higher interest rates typically strengthen the dollar, potentially increasing pressure on emerging market currencies like the rupee.

US President Donald Trump has hinted at imposing tariffs on imports from Canada, Mexico, China, and Europe.

If implemented, these policies could disrupt global trade and create further volatility in the forex market.

A stable or slightly appreciating rupee offers some relief for importers by reducing the cost of raw materials. However, exporters might face challenges as their goods become less competitive in international markets.

Exchange rate stability is crucial for controlling inflation. A stronger rupee could ease the burden of rising prices on consumers, allowing for improved purchasing power.