The Pakistani rupee closed at 278.86 on Wednesday, experiencing a slight depreciation of Re0.09 against the US dollar, according to the State Bank of Pakistan (SBP).

This move marks the second consecutive session where the rupee has shown a downturn, reflecting broader global currency fluctuations.

Global Currency Trends and the US Dollar

On a global scale, the US dollar faced slight losses on Thursday, driven by cooling US inflation data.

This has led to a decrease in bond yields, pulling the dollar back from its recent peaks. Moreover, international traders are now factoring in a potential rate hike in Japan, which further weakened the dollar.

It traded firmly around 155.21 per US dollar, reaching a one-month high as the market anticipates a Bank of Japan hike in the upcoming weeks.

In addition, US Treasury yields have seen a 13 basis point drop in reaction to inflation concerns, pushing investors towards safe-haven assets. However, the dollar index itself has continued its downward trajectory, easing to 109.02, marking a fourth consecutive session of losses.

Despite the recent pullback, the dollar index remains 0.5% firmer for January. If this trend persists, it could mark four consecutive monthly gains. Market pricing now anticipates 10 basis points of Federal Reserve easing in 2025, with 37 basis points of cuts factored in.

Interestingly, currency traders have responded with cautious optimism, as stocks have seen renewed interest. The benchmark 10-year Treasury yields have fallen significantly, although currency market reactions remain slightly subdued.

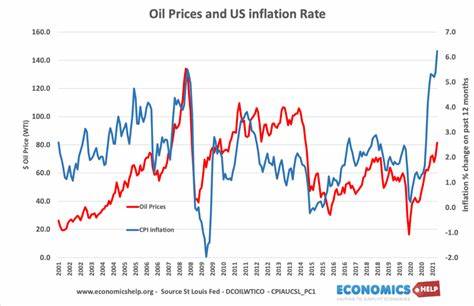

Oil Prices Impact Currency Movements

Another significant factor influencing the currency market is the movement in oil prices. Brent crude futures rose by 23 cents to $82.26 per barrel after a 2.6% increase in the previous session.

Meanwhile, US West Texas Intermediate crude futures gained 28 cents, trading at $80.32 per barrel, supported by potential supply disruptions due to US sanctions on Russia and global demand recovery.

Oil prices continue to be a key indicator of currency parity, with markets closely watching US crude oil stock movements and global supply dynamics.

This has resulted in a notable drop in US Treasury yields, while currency markets seem to have responded muted to these changes.

Looking ahead, the dollar index may face continued pressure as US inflation slows. If sustained, currency volatility could lead to further declines in the dollar’s value against major currencies like the Australian and New Zealand dollars.