The Federal Board of Revenue (FBR) has officially released tax information for the elected officials, including Chief Ministers (CM), MPs, etc for the tax year ended June 30, 2018.

The catalog, published on FBR’s official website, contains tax information on elected representatives from six different congregations. National Assembly of Pakistan, Senate of Pakistan, Assembly of Balochistan, Assembly of Khyber Pakhtunkhwa, Assembly of Sindh and Assembly of Punjab.

You may also like: Sarina Isa, Justice Faiz Isa wife penalized by FBR

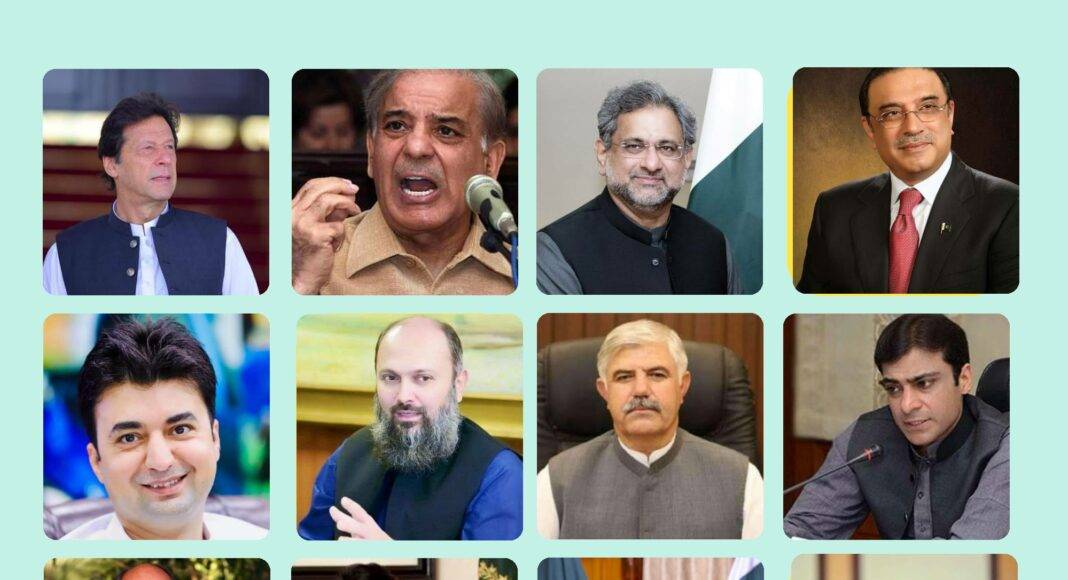

According to published information, former Prime Minister and Leader of Pakistan’s Muslim League-Nawaz (PML-N) Shahid Khaqan Abbasi was the highest taxpayer, as he paid a staggering rupees 241,329,362 in taxes.

اس سلسلے میں ایف بی آر نے "سالانہ ٹیکس ڈائریکٹری، 2018" شائع کر دی ہیں جن میں عام ٹیکس گزاروں کے ساتھ ساتھ سینیٹ، قومی اسمبلی اور صوبائی اسمبلی کے ارکان کی ٹیکس تفصیلات بھی شامل ہیں تاکہ پاکستانی عوام ان معلومات تک رسائی حاصل کر سکیں۔ 14/28

— FBR (@FBRSpokesperson) September 18, 2020

Prime Minister Imran Khan paid 282,449 rupees. PML-N president and opposition leader Shehbaz Sharif paid 9,730,545 rupees in tax and his son Hamza Shehbaz paid 8,705,368 rupees.

Former Pakistani President and PPP Co-Chairman Asif Ali Zardari paid approximately Rs 2,891,455 while his son, PPP President Bilawal Bhutto Zardari paid Rs 294,117 in taxes.

Taxes paid by provincial ministers include R808,048 from Balochistan CM Jam Kamal Khan, Rs 1,022,184 from Sindh CM Murad Ali Shah and Rs235,982 from Khyber Pakhtunkhwa CM Mahmood Khan, while Punjab CM Buzdar did not register any tax.

Other prominent incumbents were also included in the tax register, including Information and Television Secretary Shibli Faraz, Rs 367,460, Human Rights Secretary Dr. Shireen Mazari paid Rs 2,435,650, Foreign Minister Shah Mahmood Qureshi paid Rs 183,900 and Interior Minister Ijaz Ahmad paid Shah paid Rs 58,120, Defense Minister Pervez Khattak paid Rs 1,826,899, Justice Minister Farogh Naseem paid Rs 35,135 .459.

Planning Minister Asad Umar paid 5,346,342 rupees, and Aviation Minister Ghulam Sarwar Khan paid 1,046,669 rupees. Minister of Railways Sheikh Rashid Ahmed paid 579,011 rupees, Minister of Drug Control Azam Khan Swati paid 590,916 rupees.

Minister of Energy Omar Ayub Khan paid 265,055,517 rupees, States and Border Regions (SAFRON) Minister Shehryar Bangup and Bangi Halesh, Postal Services Murad Saeed 374,728 rupees , the National Minister of Food Security and Research Fakhar Imam 5,212,137 rupees, the Minister of Industry and Production Hammad Azhar 22,445 rupees,

Minister of Education Shafqat Mahmood paid 231,730 rupees and the Minister of Economy Khusro Bakhtiar Ali Zyanid 891, Minister of IT and Telecommunications Aminul Haque Rs 66,749 Asad Qaiser, President of National Assembly Rs 537,730, Senate President Sadiq Sanjrani paid Rs 1,363,414, Senate Vice President Saleem Mandviwalla paid Rs 1,591,722 and Minister of Parliament in Muhammad Khan paid Rs 30,695.

The Prime Minister’s Adviser on Finance and Revenue, Dr. Abdul Hafeez Shaikh, in the preface to the phone book, praised FBR’s efforts to ensure transparency through public access to tax information for elected officials.

“Public access to information is an important milestone in ensuring the transparency of the tax system, which is also an important pillar of the current government’s reform agenda,” he said. “I welcome the efforts of the Federal Office to prepare and publish the tax return.”

Earlier, the adviser said that the provincial elected officials paid a tax of Rs 340 million to the government and that about 90 senators and 311 members of the National Assembly paid a tax of Rs 800 million.

He added that the tax and audit systems will be automated and automated to ensure transparency of the tax system. “We want to make FBR’s tax system transparent,” he said, announcing that the institution had made two important decisions. “We are not putting the tax audit under the control of an official. It should not be that a single officer chooses the one he chooses on the exam.

“The basic philosophy of the government is to levy taxes,” he said, adding that the PTI regime wanted taxes to be imposed that would avoid unnecessary trouble and taxpayers’ harassment against businesses.